Mir-Expo 2014

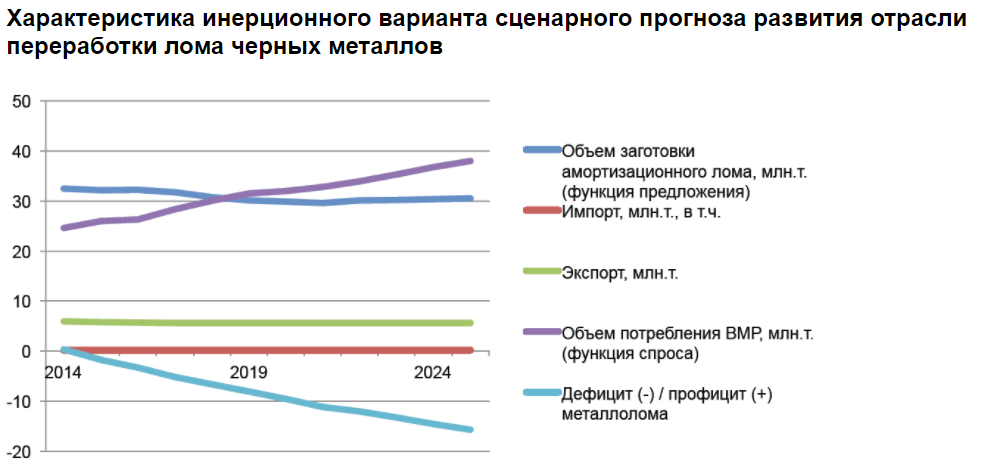

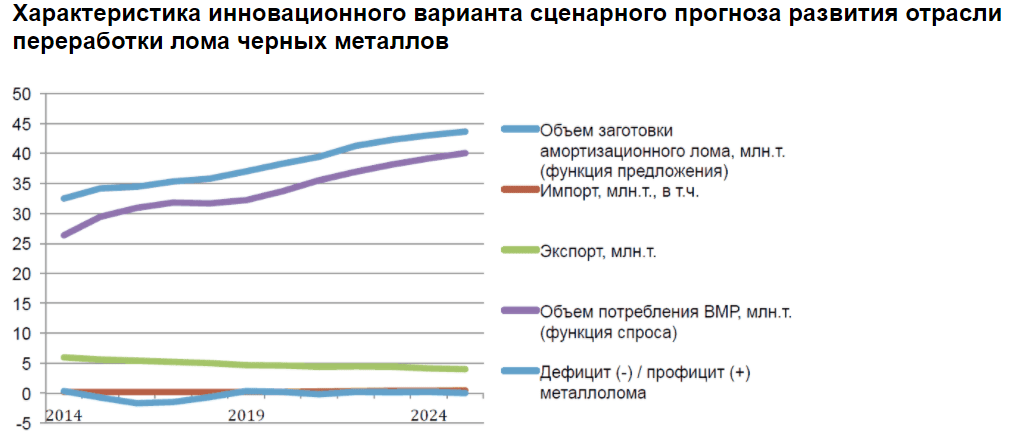

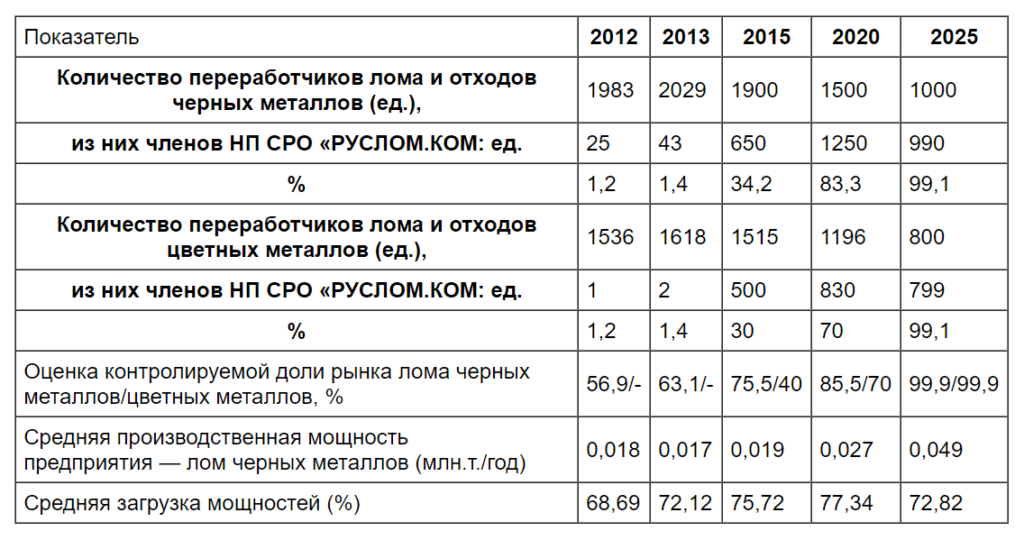

Therefore, the main task of the forum was to show how the state should support metallurgists and scrap collectors in a difficult period. How metallurgists themselves, together with scrap collectors, can significantly reduce the cost of production of metal products, increasing their competitiveness. The key question of the Ferrous and Non-Ferrous Scrap Forum is why does Russia needs metallurgy? Is it a tool for obtaining foreign exchange earnings, or the basis for all other sectors of the national economy? Everything else depends on the answer to this question: what kind of industry we will have and whether it will exist at all. Metallurgy is the flesh of industry. Of the 118 elements in Mendeleev’s Periodic Table, 96 are metals. Without its metal, there is no industry. These are construction, mechanical engineering, household appliances and electronics, medical equipment, pipes and cars, trains, and planes. People can live without oil, but not without metal. Currently, the steel industry is in a critical situation, despite the fact that the domestic metal consumption market in 2013 grew slightly. The fact is that in foreign markets, which consume almost half of our metal, the situation turned out to be very bad due to the fact that foreign consumers choose China. The Chinese Government relies on its metallurgists, giving them both internal orders for infrastructure with a large metal consumption, and helping them expand in foreign markets. China produces steel ten times more than Russia. The problem is that a lot has already been built in China, and every year it is more difficult to figure out where to put the metal, with a poor population. This means that there will be only one way out – to export more and more. We prepared ourselves for the battle to be inside Russia, for the Russian consumer. And the first real battle was lost abroad. Against this background, it is inappropriate to talk about the benefits of the WTO. If earlier we had quotas for deliveries to the EU, now, after joining the WTO, it is time to dream about those times when the metal was supplied in such quantities prescribed by quotas. In fairness, it must be said that there will also be a battle for the Russian consumer. Only under WTO rules will our hands be tied. How the scrap collector feels today determines how the metallurgical plant will feel tomorrow. And scrap collectors feel unimportant. Why is this happening? In the second half of 2013, the State Institute of Management conducted a scenario modeling of the scrap industry in Russia until 2025. A lot of work was carried out by order of the National Self-Regulatory Organization of Scrap and Waste Processors of Ferrous and Non-Ferrous Metals, Vehicle Recycling. The main result: if you leave everything as it is today, then the industry will face stagnation and gradual attenuation, a drop in all indicators. All this will soon lead to a shortage of steel scrap up to 15 million tons per year, because it is unprofitable to collect and process scrap. The most surprising thing here is that in Russia, on the contrary, there is an excess of scrap. These conclusions were made by the researchers of TsNIIChermet named after A.I. Bardin. This means that everything in the current scrap collection system needs to be changed. The industry urgently needs help. And this is not additional regulation: any restrictions and prohibitions negatively affect the market and the amount of scrap collection. The main help from the state is not to interfere with work. This is the removal of unnecessary administrative barriers and unnecessary control “for show”, which lead to an increase in the costs of scrap collectors. Scrappers and the industry will get a second wind from government recycling programs in the automotive industry. It is also very important to change the attitude of the owners of metallurgical holdings towards the industry in order to increase efficiency together. According to independent scrap collectors, Russian enterprises suffer huge losses in the existing schemes for the purchase of scrap metal. At the same time, “oxygen is cut off” for independent companies – in droves they are forced to abandon the activities that they have been engaged in for years. Every year, metallurgists face growing costs for electricity, water, gas supply, heat supply, fuels and lubricants, railway tariffs, etc. From 2001 to 2012, costs increased by 5–7 times. Sales of finished products are unstable, or, at certain intervals, do not exist at all. In an environment of weak demand and overcapacity in the global market, survival requires a bet on efficiency. Russian metallurgists can save up to 40 billion rubles on the scrap market. per year only by eliminating unnecessary administrative barriers and changing the scrap procurement system. Metallurgists cannot regulate gas prices. And for many other items of expenditure, it is possible. From year to year, there is a change in the legislation regulating the scrap collection industry. New laws and by-laws appear that complicate and increase the cost of doing business. Most often, new acts and additions to already working rules are not discussed in a professional environment, but appear as if from nowhere and, as it were, are not lobbied by anyone. At the same time, an additional financial burden is imposed on the enterprises of the industry. NP SRO “RUSLOM.COM” is working on the analysis of the rules and laws in force in the field of circulation of ferrous and non-ferrous scrap. The main goal is to eliminate unnecessary administrative barriers, reduce industry costs and increase competitiveness. The first result of the work was a draft legislative proposal to amend the law Federal Law No. 54-FZ dated May 22, 2003 (as amended on November 25, 2013) “On the use of cash registers in cash settlements and (or) settlements using payment cards” in part of article 2 “Scope of cash registers” of paragraph 3. The task is to cancel the mandatory use of cash registers (hereinafter referred to as cash registers) in operations with ferrous and non-ferrous scrap. The requirement to use cash registers is redundant, duplicating the reporting of personnel and enterprises. The use of cash registers complicates and complicates the work of accounting employees of enterprises, due to staff errors, leads to significant penalties from the Federal Tax Service. The Law on Accounting and the accounting rules of enterprises oblige and allow control over the expenditure of funds issued for the purchase of scrap metal through the preparation of advance reports, expenditure and receipt-cash orders, forms of strict reporting forms. The use of cash register does not cancel the execution of these documents and the obligation of the enterprise to control the funds issued under the report. metal from the public is also confirmed by expert assessments and the opinion expressed by the Cassation Board of the Supreme Court of the Russian Federation (December 19, 2002, Determination No. KAS 02–624). This initiative will reduce the annual costs of the scrap industry by 1 billion 380 million rubles a year. Rail transport costs have become so high that the share of road transport has grown rapidly from 30% to nearly 50%. January 30, 2014 Deputy. Chairman of the Government of the Russian Federation Dvorkovich A.V. gave instructions to ministries and departments to propose measures to equalize tariffs for the transportation of scrap. It is good that attention to this issue is at a high level. One of the many reasons for the high tariffs for rail transport is associated, for example, with the requirement of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare to carry out sanitary and epidemiological conclusions for each shipped wagon batch of scrap metal. Clause 12 of Appendix 5 of Order No. 776 of November 21, 2005. “On the sanitary and epidemiological examination of activities (works, services), products, project documentation.” The absurdity of spending on additional radiometric monitoring is obvious. The procedure for handling scrap and waste of ferrous metals requires primary radiation monitoring from processors of scrap metal. All scrap metal collection points are equipped with special devices, the enterprises have trained and educated personnel who carry out primary radiation monitoring of incoming scrap. The second time the scrap metal is checked when it arrives at the metallurgical enterprises. Despite the actual double radiometric control of scrap metal, an additional service is required from the SES (RosPotrebNadzora) to control the shipped batch of scrap metal. The cost of such a service is on average 1200 rubles per car. The number of railway shipments of scrap metal shipped in 2013 amounted to 304.5 thousand. Thus, the industry took on additional expenses in the amount of 365 million rubles a year. The third segment where the industry incurs unreasonable costs is staff appraisal. The cost of certification is 5-7 thousand rubles. The industry employs 30 thousand people. This means losses of 1.5–1.8 billion rubles. Obviously, real certification is needed, but in reality, it turns out to be simple paperwork by companies that specialize in this – it is in registration, not certification. This issue must be transferred to the competence of self-regulation – professional market participants themselves will figure out what and how to do it. Due to the difficult situation on the market, a number of owners of Russian scrap collection companies decided to contact the owners of the plants directly: “As owners, we have common goals: business must be profitable. Therefore, we draw attention to the important issue of the effectiveness of joint work in the field of supplying metallurgical industries with steel scrap, which accounts for up to 30% of the cost of rolled metal.” Today, independent companies raise questions and complaints about the economic policy of metallurgical plants in relation to their subsidiary scrap collection companies, whose purchase prices for scrap and ferrous metal waste are much higher than in the market as a whole. The difference in price can be 300-500 rubles and reach up to 1000 rubles per ton. This creates unhealthy competition for other players, which, in turn, excites and feverish the market. At the same time, the metallurgical plants themselves lose these 300-1000 rubles per ton. According to Rusmet.ru’s calculations, the industry’s total losses here range from 15 to 35 billion rubles. In this regard, the owners of independent companies offer metallurgical plants to set the same market price for ferrous scrap to both their own and independent suppliers, and as a result, receive raw materials at a much lower cost. Metallurgists are the first who can thank for such work. Everyone is now struggling to reduce costs, and in this case there is practically uncontrolled pricing, so they are interested in obtaining objective information on prices from an independent source, and not from their subsidiaries. It was proposed to create an information product that contains the prices of all plants at the current time. Also, after the end of the month, it is recommended to impose the actual shipments according to the railway base on these prices and, together with the estimated tariffs, calculate the price at the plants for the month. Thus, the calculated price for enterprises would be very different from the actual price, taking into account the invisible premiums to subsidiaries. The management of metallurgical holdings will certainly pay attention to this problem. Representatives of subsidiaries reacted immediately. In response, they accused analysts of inaccurate calculations, and independent scrap collectors of not being able to supply the required amount of scrap themselves … To ensure raw material security, the largest metallurgical holdings went to create their own scrap collection networks. Enormous funds have been spent on the construction of subsidiaries. In the opinion of independent scrap collectors, none of the subsidiaries fulfills its purpose and does not fully cover the needs of enterprises included in these metallurgical groups. With the launch of new capacities of enterprises, the share of provision with own scrap will still decrease. However, these management companies have become monopoly suppliers of scrap metal for their parent companies – metallurgical holdings. They supply scrap, harvested in-house at their own recycling facilities and purchased in large quantities from independent suppliers. At the same time, the purchase price is not determined at the metallurgical enterprises that consume scrap, but is set at the scrap metal management companies, for which the highest sale price is the most preferable. This state of affairs helps management companies to manipulate the parent metallurgical companies-consumers, in fact, setting an arbitrary price, which is used to subsidize secondary metal and increase earnings on resold scrap from independent suppliers. At the same time, none of the subsidiaries is unconditionally profitable; The reason for the losses is the systematically inflated selling price for the secondaries of these companies. This difference is 300–1000 rubles. per ton reflects for metallurgical enterprises-consumers the value of scrap that they could save if they independently purchased scrap metal on the market without the intermediary services of their scrap metal management companies. This state of affairs allows the vtormets of the scrap metal management companies to do nothing, just reselling scrap from independent suppliers in their regions, up to the shipment of independent suppliers completely through their railway details. So some large scrap metal companies completely ship under the details of the subsidiaries of the plants. In addition, management companies are often in constant debt to their parent metallurgical enterprises for the supply of scrap metal, so metallurgists not only buy scrap at an inflated price but also advance the activities of inefficient companies, an inflated price, which creates the possibility of a lot of abuse for them. Raw “independence” of metallurgists in scrap is extremely expensive for them. To draw up an objective picture, serious calculations are required with the participation of representatives of both independent scrap collectors and subsidiaries. Rusmet invited all interested parties to cooperate – price data on scrap purchases in the regions are required. Foreign experience shows that the scrap business is always separated from the metallurgical business. Well-known enterprises in the world also at first sought to create their own scrap collection, but the market put everything in its place – it became more profitable to purchase scrap from independent suppliers. The study of scrap purchase schemes for manufacturers will be presented on April 3, 2014 in Moscow at the Rusmet conference on the organization of mini-mills and electric steelmaking. It is obvious that the state, metallurgists and scrap collectors need a new strategy. The Ministry of Industry and Trade of the Russian Federation has begun to develop such a strategy. according to the instructions of the Chairman of the Government of the Russian Federation D.M. Medvedev. during a visit to Chelyabinsk in July 2013. Russian metallurgy depends both on the situation in the domestic metal consumption market, the state of export markets, which consume 30-80% of manufactured products, as well as on the development of metallurgy in competing countries. A strategy is an action document that should take into account the best global practices of the metallurgical business. It is important to know that in all industrialized countries there are measures of state regulation and support for the metallurgical industry through support for metal-consuming industries. The key problem here is that in Russia they are used to producing ordinary steel grades. Everything related to high-quality special steel, for example, if we take an auto sheet for analysis, then there will be problems associated with the fact that years of work of specialists are required to launch and debug the technology. This is in addition to the fact that a significant increase in investments is also required for branch science. Today, these investments in Russia lag behind the world average by dozens of times, and if compared with Japan or Korea, by hundreds. Self-regulation in the industry under the Federal Law “On Production and Consumption Wastes”, which will introduce recycling fees for all goods in Russia, opens up new prospects for stimulating demand for metal products. It is required to develop and launch recycling programs in the transport engineering industry in Russia. In addition to stimulating demand in the automotive, shipbuilding and car building industries, recycling programs will provide an additional 10 million tons of ferrous scrap and up to 0.7 million tons of non-ferrous scrap. The recycling programs are fully consistent with the strategies for the development of the listed industries until 2020–2030, developed by the Ministry of Industry and Trade of the Russian Federation. In Russia, as of 2014, the vehicle recycling industry exists, but fragmentarily. For example, only 83 shredders are needed for car recycling (for comparison, today there are 313 shredders in the EU and 13 in Russia). Investments will go to special equipment (60%) and infrastructure (40%). Necessary investments to build a high-tech industry: car recycling – 83-110 billion rubles, wagon recycling – 12-15 billion rubles, ship recycling – 55-70 billion rubles. An important point: it is required to create a system of motivation for owners of old equipment through recycling premiums, which are expressed in the provision of discounts on the purchase of new equipment. Taking into account the introduction of recycling fees for all new cars of Russian and foreign production, the state budget expenditures will amount to 500 million rubles per year, if manufacturers are given the right not to pay the recycling fee. Investments in equipment and infrastructure and the motivation system will be carried out on the principles of PPP. With the amendments to the law on production and consumption waste, indicated below, the total state budget expenditures will amount to no more than 10% of the entire project of the recycling program in transport engineering. Automotive and shipbuilding, as well as car building, are closely tied to related branches of engineering and metallurgy. These are thousands of contractors and design organizations, these are metallurgists and raw materials processors. This is providing employment for 10 million economically active population Based on the experience of waste management in Russia and abroad, in particular, on the collection and further distribution of disposal fees, it should be recognized that industrialized countries in their state economic policy rely on the industry in which goods that have lost their consumer properties are processed and give life to new goods – there is a constant circulation of goods. End-of-life products do not become garbage, but are returned back to production. One of the main tools for implementing such a state policy is recycling (environmental) fees. The main task of recycling fees is to accumulate funds for further distribution in the form of subsidies or subsidies to processing industries, as well as to stimulate (create motivation) citizens and legal entities to hand over used goods and packaging to collection points for further recycling. The fleet of wheeled vehicles in Russia as of January 1, 2014 exceeded 55 million units. This number will increase annually from 2 million to 4 million. In the Russian Federation, there is an incomprehensible situation with recycling fees in the automotive industry: if everything is left as it is today, no new processing facilities for end-of-life vehicles will be created, and the existing utilizers of end-of-life vehicles will be forced to curtail their activities, since until now So far, no incentives have been created for citizens to hand over old cars for recycling, and for recyclers to recycle them. At the same time, the scrappage fee becomes an additional financial burden that strikes at Russian car manufacturers and their dealers. According to the Federal Law of October 21, 2013 No. 278-FZ “On Amendments to Article 24.1 of the Federal Law “On Production and Consumption Wastes” in Russia, from January 1, 2014, recycling fees are charged from all manufacturers and importers of vehicles without exception. In fact, with this, automakers and importers were deprived of the right to independently dispose of obsolete vehicles or transfer them to recyclers, which contradicts the main provision of the Federal Law on Production and Consumption Waste, namely, Article 24 in the new edition: “Manufacturers, importers of goods subject to recycling after the loss of consumer properties, including the consumer packaging of such goods, they are obliged to ensure their disposal in accordance with the standards for the disposal of waste products. The obligation to dispose can be implemented in three ways: 1) transfer of goods (products) to be disposed of to processors; 2) independent disposal; 3) payment of the recycling fee. At the same time, the adopted Federal Law No. 278-FZ of 21.10.2013 makes it impossible for the state to establish and control recycling standards in the automotive industry, since the unconditional payment of recycling fees frees automakers and importers from any obligations related to recycling. The lack of economic incentives for recycling makes this type of activity unprofitable for all categories of vehicle owners in the life cycle of production, operation and disposal of the car. It is unprofitable for manufacturers and importers to engage in recycling, since they have paid the recycling fee and the obligation to dispose according to the law has been fulfilled. It is unprofitable for owners of decommissioned vehicles to hand them over for recycling, because a fee has been paid for new cars and, according to the law, they are not obliged to do anything for their actual disposal, and old cars released before September 1, 2012, generally remained outside the scope of this law. It is unprofitable for vehicle utilizers, because there is no steady flow of cars for recycling and there is no mechanism for compensating the costs of their disposal, which, depending on the utilization of processing capacities (the lower the load, the more expensive it is to dispose of one car), can range from 6000 to 27000 rubles, if we take into account the utilization of both metal and tires, process fluids, textiles, plastic and glass. The main breakthrough in the direction of creating high-tech car recycling is expected in the Moscow region. In Moscow in 2013, 5 million cars were registered. Together with the Moscow region, the park is 8 million cars. For Moscow, this is a critical situation: it is already difficult to park in the yards – there have been repeated cases when people died for a parking space. Taking into account the shortage of free places and the increase in road congestion, it is necessary to observe the principle from 2020: how many cars arrived on the market, exactly as many were disposed of. By 2020, the number of cars will be 10 million. This means that at the current growth rate of the fleet in the Moscow region by 6%, it is necessary to build processing capacities from 300 to 600 thousand cars per year, taking into account the possible sale of some cars to the regions. Taking into account the load of 50 thousand cars per year for 1 center, a total of 10 centers are required for the Moscow region by 2020. The average cost per center is 900 million-1.4 billion rubles, taking into account the cost of land, infrastructure and equipment. This means that the required investment in Moscow will amount to 13-17 billion rubles. for the next 5 years. And it will also require investments to create a system of motivation for the renewal of the park. Obviously, taking into account environmental requirements, a limitation on the service life of machines will follow. And it is likely that special, increased recycling premiums will be introduced for the purchase of electric vehicles by citizens, which will help reduce car emissions by 40% and improve the environmental situation. Using the example of the Moscow region, it will be clearly shown that auto-disposal is also a system for collecting batteries and used tires, which are changed every three years. In Russia, in 2012, the National Self-Regulatory Organization of Scrap and Waste Recyclers of Ferrous and Nonferrous Metals, Vehicle Recycling was established, which includes both the largest consumers of scrap (metallurgical plants such as Severstal, NLMK, OMK) and independent scrap recyclers with 100 % capacity of operating shredders. Taking into account the fact that vehicles consist of 70-95% of metal, the control over the implementation of a safe recycling process can be carried out by this self-regulatory organization throughout Russia. For the scrap market, any regulation is inherently meaningless. Because “on earth” scrap is being harvested by living people, for whom free will is of great importance. That is why, the more restrictions there are on the market, the lower the scrap collection, at the same time, the number of those who decide to work without licenses and without any rules is growing. Experts note the inefficiency of the current licensing system, which has turned from a control system into a market for securities that are bought and sold. Cancellation of licensing is possible under two conditions – the introduction of a new law on scrap and the readiness of the scrap collectors and metallurgists themselves to organize control throughout the country. This is a self-regulatory system. The preparatory period will take 1.5–2 years. The concept of Russia as a source of raw materials for the rest of the world provides for the maximum encouragement by the state of the export of metallurgical raw materials and semi-finished products. In recent years, raw materials accounted for half of the metallurgical exports. Russia deservedly takes the first place in the world in the supply of ferrous and non-ferrous metals in the form of slabs, billets and ingots. Therefore, any restrictions on the export of scrap are nothing more than the distribution of income from one market participant to another. If we take a simple decision – to ban exports altogether, then both the economy and the environment will be hit. Not to mention the fact that with a ferrous metal fund of 1.5 billion tons, natural losses from natural impacts amount to up to 25 million tons. in year. That is, scrap may not be collected at all, but the decrease in the metal fund will still be. For reference, the peak of scrap export was in 2004-2005, amounting to 10 million tons. In 2013, Russian exports did not exceed 3 million tons. Our competitors did not sleep. During the same period, the United States increased its export of scrap from 10 million tons to 20 million tons, taking the place vacated by Russia. What is the conclusion? It is easy to refuse foreign exchange earnings, only our competitors do not want to follow this path. The state, metallurgists and scrap collectors are at a crossroads. Now the main question is not where to go, straight ahead, left or right. The main thing is that we need to go together, having an understanding that forces act on metallurgy at the global and national levels. The global level is a change in the structure of the world market of raw materials, due to overcoming the causes and consequences of the financial and economic crisis, and the formation of infrastructure and mechanisms for the functioning of a green economy: from environmental protection to environmentally safe reproduction of resources for the development of society. The national level is the formation in Russia of a national model for managing the innovative development of Russia, focused on the modernization and reindustrialization of the economy. This is a transition from the budget to the program and from the short-term to the medium-term concept of budget planning, which ensures the achievement of the effect of indicative regulation of the public and market sectors of the economy. This is the introduction of a system of recycling fees for a wide range of products from January 1, 2015 and for everything from January 1, 2016. From January 1, 2014, all Russian car manufacturers and car importers pay recycling fees. Annual fees will amount to 200 billion rubles. The scrap industry needs consolidation. Naturally, not through the creation of another dray “supermonopoly”. It is required to unite market participants into an association based on the principles of self-regulation, which protects the interests of scrap collectors and at the same time assumes the functions of a market regulator. When assessing the prospective dynamics of the industry, the parameters of the forced scenario for forecasting the socio-economic development of Russia with the following structure of average annual increases in the main indicators (%) were taken as the basis for experimental calculations. The main hypotheses and parameters of scenario modeling of the industry development: uniform pace of implementation of strategic programs of the basic sectors of the economy (military-industrial complex, mechanical engineering, shipbuilding, aircraft building, transport, energy, construction, etc.); phased introduction of standards and regulations for the disposal of products; Decreased elasticity of demand for scrap prices; a permanent structure for the extraction of scrap from the accumulated metal fund; smoothness of changes in the ratio of retirement and renewal rates of fixed assets. Установлено возникновение в интервале 2016–2017 гг. и дальнейшее нарастание дефицита лома; кратковременный и незначительный эффект покрытия дефицита за счет ограничения экспорта металлолома (временной лаг возникновения дефицита составляет 2–3 года). The innovative scenario provides for: modernization and growth of modern production facilities; accelerated introduction of product disposal regulations; development of a mechanism for managing the resources of the utilization fund; creation of the infrastructure of the federal recycling network (enterprises for the disposal of complex technical products, the disposal of vehicles). The target development trajectory and the basic forecast guidelines for the development of the scrap industry: from the historically perfect diversified system of the Soyuzvtormet concern in the administrative economy (1980–1985) through destructive processes and the subsequent restoration of state regulation mechanisms in the transition economy (1985–2012), to a high-tech self-regulating industrial the competitive sector cluster in the social economy (2012–2025). 08:30–10:00 Регистрация. Приветственный кофе 09:40–10:00 Рассадка в зале согласно выбранным столам 10:00–10:30 Открытие, вступительные слова. Ситуация на рынке критическая. Многие говорят про худший период с 1993 года. Не все ломозаготовители уверены, что смогут пережить зиму. «Полуживые» российские потребители, «полуживой» крупнейший внешний покупатель российского лома — Турция. Задача сессии — определить , что будет в ближайшее время. Выступления, экспертные мнения, дискуссии 11:50–12:20 Перерыв Острые вопросы: цены «на земле», излишнее регулирование и контроль рынка со стороны государства, перевозка лома ж/д и автотранспортом, нелегальные пункты приема лома, запрет экспорта лоама из Казахстана. Главным вопросом является ценообразование на лом у комбинатов. Особенно острой проблемой стала конкуренция «на земле»: цены на лом у независимых компаний и дочерних сетей российских заводов. Ценообразование «на земле» на лом черных металлов для дочерних и независимых компаний. 14:00–15:00 Перерыв. Обед. Обсуждение стратегии развития черной металлургии до 2030 года. Документ разрабатывается Минпромторгом РФ согласно поручению Председателя Правительства РФ Медведева Д.М. во время посещения Челябинска в июле 2013. Какая роль ломозаготовителей до 2030 года? Какие меры необходимы для увеличения ломосбора? Что будет в России, когда Китай станет крупнейшим поставщиком лома на мировой рынок. Регулирование и саморегулирование в отрасли в условиях ФЗ «Об отходах производства и потребления», который введет для всех товаров в России утилизационные сборы. Ковшевный Виктор Викторович, генеральный директор Центра «Интеллектуальные ресурсы» МИСиС Презентация завода и оборудования HuaHong (ХУА ХУН). На сцену выходят до 7 компаний, 1 ведущий. Чтобы ломопереработчики конференции могли принять объективные решения по закупке оборудования, всем задаются стандартные вопросы и дается время на ответ 30 сек.–2 мин. 18:00–20:00 Фуршет, деловое общение. 09:30–10:00 Регистрация. 09:45–10:00 Рассадка в зале согласно выбранным столам. 10:00-10:05 Открытие второго дня, вступительные слова. 10:05–10:20 Переход от лицензирования к саморегулированию на рынке лома 11:30–12:00 Перерыв. Кофе. c 1 января 2014 года в России утилизационные сборы взымаются со всех российских производителей и поставщиков импортных машин. 13:30–14:30 Перерыв. Обед. 2 программы на выбор: 14:30–16:00 2. Сессии. Только за декабрь-январь отозваны лицензии десятков банков, в том числе банки из TOP-100! На этом фоне ряд экспертов утверждает, что банковский сектор России на пути дестабилизации. Как не потерять деньги бизнесу, ведь корпоративные деньги не застрахованы. Стоит ли предприятиям выводить активы из средних и мелких банков в наиболее крупный сегмент? Как обезопасить себя при взаимодействии с ненадежными кредитными организациями. Документ разрабатывается Минпромторгом РФ согласно поручению Председателя Правительства РФ Медведева Д.М. во время посещения Челябинска в июле 2013. 16:10–16:30 Подведение итогов.

Warm & Powerful Design Inside

The world metallurgy is currently in a recession, so the meetings of market participants are of great importance in creating a real picture of what is happening. On February 19–20, 2014, more than 300 delegates from 20 countries gathered at the Rusmet Forum “Ferrous and non-ferrous scrap metals”. Within 2 days, 100 reports and expert opinions were made in the format of presentations and round tables. It was noted that the scrap market has become aggressive and at the same time not as marginal as before. The situation is complicated, everyone is breathing heavily – both metallurgists and scrap collectors. Despite the continuation of the crisis at least until the end of the current half of the year, expectations for 2014 are generally optimistic: the growth in metal consumption by the end of the year will be up to 5%. The situation in Russia strongly depends on the actions of the state: if nothing is done, then foreign competitors will press the Russians on all fronts.

The world metallurgy is currently in a recession, so the meetings of market participants are of great importance in creating a real picture of what is happening. On February 19–20, 2014, more than 300 delegates from 20 countries gathered at the Rusmet Forum “Ferrous and non-ferrous scrap metals”. Within 2 days, 100 reports and expert opinions were made in the format of presentations and round tables. It was noted that the scrap market has become aggressive and at the same time not as marginal as before. The situation is complicated, everyone is breathing heavily – both metallurgists and scrap collectors. Despite the continuation of the crisis at least until the end of the current half of the year, expectations for 2014 are generally optimistic: the growth in metal consumption by the end of the year will be up to 5%. The situation in Russia strongly depends on the actions of the state: if nothing is done, then foreign competitors will press the Russians on all fronts.People can live without oil, but not without metal

The situation in the Russian metallurgy

The current situation in the scrap market – the industry urgently needs help

Russian ferrous metallurgy incurs extra costs

Dynamics of growth in expenses of ferrous metallurgy enterprises of the Russian Federation

Unnecessary control leads to losses in the amount of 4 billion rubles. in year

Financial hole as a payment for raw material security

The existing schemes for the purchase of black scrap by Russian factories. The point of view of independent scrap collectors.

Strategy for the Russian metallurgy until 2030

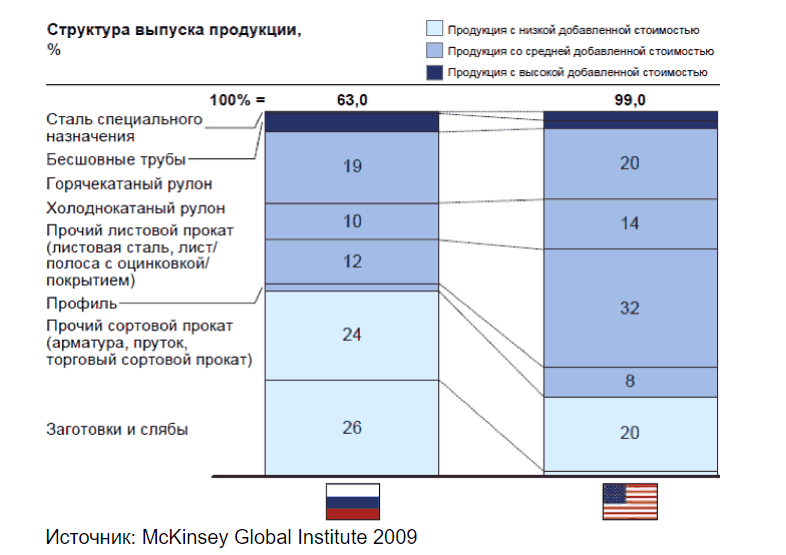

In Russia, the share of low value-added products is significantly higher than in the US

Opportunities to increase scrap collection in Russia

Recycling programs in transport and mechanical engineering in Russia

World experience in the use of recycling fees

Autoutilization today in Russia

Moscow is the capital of car recycling

Administration and control of recycling programs

Licensing will be canceled in the near future

Does Russia need to export scrap?

Conclusions. How scrap collectors choose an innovative scenario.

Characteristics of the innovative variant of the scenario forecast for the development of the ferrous scrap processing industry

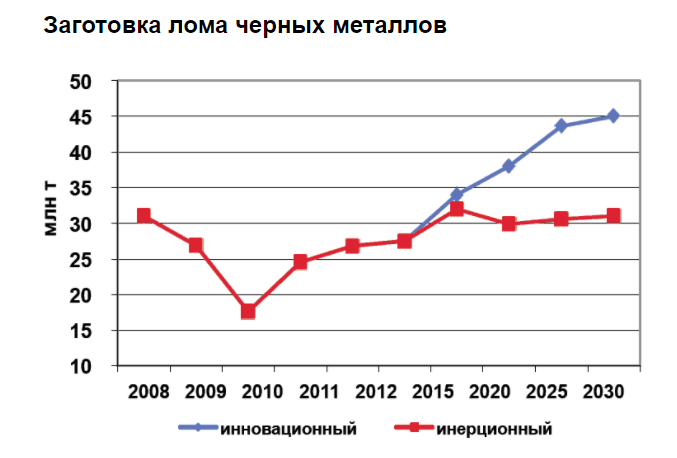

Procurement of ferrous and non-ferrous scrap in inertial and innovative scenarios

Программа

19 февраля 2014 года

Зал Андреевский

Какие поручения относительно рынка лома даны министерствам и ведомствам заместителем Председателя Правительства РФ Дворковичем А.В.

10:30–11:50 1-я сессия. Сколько еще терпеть? Ситуация на рынке.

Жиляев Кирилл Вячеславович, Главный аналитик Аналитического департамента Дирекции стратегического планирования УК «ЕвразХолдинг»

Осадчий Николай Михайлович, Руководитель проекта «Металл-Курьер»

Моисеенко Андрей, Укрмет, Украина, член коллегии направления стального металлолома BIR

Дементьев Дмитрий Владимирович, Специалист по внешненторговым вопросам Sidley Austin LLP

Гончаров Георгий Владимирович, Коммерческий директор METALRESEARCH LLC

12:20–13:30 2-я сессия. Как поднять эффективность работы ломозаготовителей.

НП заготовителей, переработчиков лома и опасных отходов «Металлальянс»

Найденко Ольга Борисовна, Кравченко Сергей Юрьевич

Неверов Ильдар Алиевич, Бизнес-омбудсмен по экологии и природопользованию Управления Уполномоченного по защите прав предпринимателей при Президенте РФ, Представитель BIR в России

Чижиков Алексей Геннадьевич, старший аналитик Русмет

О внесении изменения в закон Федеральный закон N 54-ФЗ от 22.05.2003 (ред. от 25.11.2013) «О применении контрольно-кассовой техники при осуществлении наличных денежных расчетов и (или) расчетов с использованием платежных карт» в части статьи 2 «Сфера применения контрольно-кассовой техники» пункта 3.

Неклюдов Виталий Юрьевич, генеральный директор ООО «ЛЕВЕЛ», руководитель комиссии по отмене излишних административных барьеров НП НСРО «РУСЛОМ.КОМ»

Metkim Metal Makina Kimya San. ve Dis Tic. Ltd. Sti., Selim Argun, Sales Manager

Цель — оценить сколько переплачивается за лом комбинатами при его покупке у дочерних компаний.

Родионов Михаил Николаевич, зам.директора Русмет;Выступления, экспертные мнения, дискуссии

15:00–15:40 Церемония награждения участников «Кто лучший на рынке лома?»

15:40–16:40 Перспективы рынка лома до 2030 года.

Эксперты:

Лом — отрасль высокий технологий. Стратегия отрасли до 2030 года.

Экспертные мнения и дискуссии

16:40–17:40 4-я сессия. Оборудование: новое и б/у.

Генеральный директор HU PIN LONG (ХУ ПИНЬ ЛУН)Круглый стол с поставщиками оборудования «Живой рынок — живые вопросы»

Вопросы:

Представители компаний

20 февраля 2014

Зал Георгиевский

10:20–11:30 5-я сессия. Экспертные доклады о ситуации на рынке лома черных и цветных металлов.

Гончаров Георгий Владимирович, Коммерческий директор METALRESEARCH LLC

Найденко Ольга Борисовна, Председатель НП заготовителей, переработчиков лома и опасных отходов «Металлальянс»

Тарнавский Виктор Вадимович, главный аналитики Русмет

Петров Игорь Михайлович, генеральный директор Инфомайн

Бушмелев Валерий Викторович, заместитель директора ООО «Урал-Золото» по сырью, член рабочей группы «Арктика» (Чилингарова А.Н.) руководитель направления утилизации ломов цветных и драгоценных металлов

Verband Deutscher Metallhandler (Ассоциация трейдеров лома цветных металлов), Ralf Schmitz, Managing Director12:00–13:30 6-я сессия. Новые направления бизнеса для переработчиков.

12:00–12:15 Ртутьсодержащие отходы: cоздание в России системы утилизации компактных люминесцентных ламп.

12:15–13:30 Создание отрасли авторециклинга в России.

Эксперты:

14:30–17:00 1. Экскурсионная программа для делегатов форума.

14:30–15:30 Финансовая сессия «Черные списки банков: как не потерять деньги».

Экспертные мнения:

Ключевые вопросы:

15:30–16:10 Обсуждение стратегии развития цветной металлургии до 2030 года.

Список участников

компания

должность

страна

ABLV Bank

Кредитный менеджер

Латвия

Akademie der fuerenden Technologien e.V. (ADFT e.V.)

Председатель совета общества

Германия

Akademie der fuerenden Technologien e.V. (ADFT e.V.)

Руководитель проетов

Германия

АТМ Recyclingsystems

Региональный представитель в России и СНГ, ATM-Metal Recycling Syste

Россия

АТМ Recyclingsystems

Sales Director Russia and CIS Россия

Россия

АТМ Recyclingsystems

CEO – Австрия

Австрия

АТМ Recyclingsystems

Sales Director, Austria

Австрия

BLN-HIT

Россия

Continuus-Properzi

Representative in Russia

Италия

COPEX S.A.

Chief Executive Office

Франция

COPEX S.A.

Responsable commercial COPEX Russie et CEI

Россия

Cronimet

Scrap trader stainless steel

Нидерланды

Cronimet

Scrap trader stainless steel

Германия

Cronimet

Scrap trader stainless steel

Германия

Dorce Prefabricated and Construction Industry Trade Inc.

Директор по развитию бизнеса

Турция

Ermetal

Director, scrap trading

Турция

Essar Steels

Chief Commercial Officer

Индия

Eurosteel

Manager & Super Alloys Manager

Италия

GMT Metal

Director

Турция

HuaHong

Акционер

Китай

HuaHong

Генеральный директор

Китай

HuaHong

Руководитель отдела продаж на Россию

Китай

HWH Machines

Director

Германия

HWH Machines

Technical Director

Германия

Imabe Iberica

Технический директор

Испания

Imabe Iberica

Коммерческий директор

Испания

Imabe Iberica

Переводчик

Испания

Imabe Iberica

Technical Specialist Imabe Iberica

Испания

Infomine Research Group

Генеральный директор

Россия

KSP Steel

Начальник отдела стального сырья

Казахстан

KSP Steel

Исполнительный директор

Казахстан

Mergermarket

Корреспондент, Россия/СНГ

Великобритания

Metalresearch

Коммерческий директор

Россия

Metalresearch

Директор, ведущий аналитик по металлам

Россия

MetalRussia, Журнал

Россия

Metkim Metal

Sales Manager

Турция

Metso Lindemann

Cтарший менеджер по продажам. Переработка металлических и бытовых отходов

Россия

MG Recycling

Менеджер по продажам

Россия

Moscow Bureau Business Day

Россия

Platts

Marketing Manager Russia, FSU, Eastern Europe

Россия

Port Of Sillamae

Commercial Manager Port of Sillamae

Эстония

Recycling International

Journalist

Нидерланды

Rimeco

Director

Дания

Rot-Berg

Италия

S.C. Remat Valcea

Commercial Manager

Румыния

Scholz Recycling

Purchase/Sale Manager

Германия

SIDCO

Учредитель

Австралия

Sidley Austin

Специалист по внешненторговым вопросам

Бельгия

SSAB

Региональный менеджер по продажам

Россия

SSAB

Региональный менеджер по продажам SSAB EMEA

Россия

Starglobe

Начальник отдела сырья и материалов

Швейцария

TECHCOM

Коммерческий директор

Германия

TECHCOM

Директор представительства

Германия

Terex Deutschland

Sales Director CIS & EE Terex Deutschland GmbH, BU TEREXIFuchs

Германия

Terex Deutschland

General Manager Terex Deutschland GmbH, BU TEREXIFuchs

Германия

Ventilatorenfabrik Oelde

Sales Manager Recycling Plants

Германия

Ventilatorenfabrik Oelde

Area Sales Manager Large and special fans

Германия

Verband Deutscher Metallhandler

Managing Director

Германия

Wiederkehr Recycling

CEO

Швейцария

Zato

Managing Director

Италия

Zato

Италия

Адвокатское Бюро ЕПАМ

Адвокат

Россия

Акрон Метал Груп

Генеральный директор

Россия

Акрон Метал Груп

Директор департамента сбыта и ВЭД

Россия

Алком

Директор

Россия

Алком

Директор по развитию

Россия

Алтайвагонснаб, ТД

Ведущий менеджер

Россия

Альфа Металл

Заместитель генерального директора

Россия

АНС ГРЕЙФЕР

Директор

Россия

АНС ГРЕЙФЕР

Коммерческий директор

Россия

Ассоциация российских банков

Вице-президент

Россия

Белцветмет

Заместитель директора

Беларусь

БМЗ г. Санкт-Петербург

Директор

Россия

БМЗ г. Санкт-Петербург

Заместитель директора по закупкам

Россия

БМЗ-УКХ «БМК»

Заместитель генерального директора по коммерческим вопросам

Россия

Брансвик Рейл Менеджмент

Руководитель коммерческого департамента

Россия

Волгавтормет г. Волгоград

Директор

Россия

Восток-Транзит

Заместитель директора

Россия

Вторичные металлы

Коммерческий директор

Россия

Втормет г. Махачкала

Генеральный директор

Россия

Втормет, Промышленная компания

Закупка алюминиевого сырья

Россия

Втормет, Промышленная компания

Председатель Совета Директоров ООО “Промышленная компания “Втормет”

Россия

Втормет, Промышленная компания

Закупка алюминиевого сырья

Россия

Вторметсервис

Коммерческий директор

Россия

Вторчермет НЛМК

Начальник отдела маркетинга

Россия

Грасгрупп

Генеральный директор

Россия

Даниэли Хеншель

Директор по продажам в СНГ

Россия

Даниэли Хеншель

Директор по маркетингу

Россия

Днепропетровский Втормет

Начальник отдела заготовки лома

Украина

ДонЛом

Генеральный директор

Россия

ЕвразХолдинг

Главный аналитик. Департамент стратегического планирования.

Россия

ЕвроХим

Главный специалист ОИО, Старший менеджер по оптимизации непрофильных активов

Россия

ИмпэксТрейд

Председатель Совета директоров

Россия

ИмпэксТрейд

Генеральный директор

Россия

Институт Экологического и Энергетического Менеджмента (ИЭЭМ)

Генеральный директор, Сертифицированный эксперт “UNIDO”.

Россия

Интерметтрейд

Генеральный директор

Россия

Интерпайп Украина

Ведущий специалист отдела стратегического анализа

Украина

Казвторчермет

Начальник аналитического отдела

Казахстан

Камвтормет

Заместитель генерального директора по сбыту

Россия

Каменск-Уральский завод по обработке цветных металлов

Директор по закупкам

Россия

КарИнтерПром

Директор

Казахстан

Каскад

Директор

Россия

Катерпиллар Евразия

Менеджер по развитию бизнеса

Россия

КВИНТМАДИ

Руководитель отдела портовых, интермодальных кранов и универсальных перегружателей

Россия

КВИНТМАДИ

Менеджер по продажам II категории

Россия

КВИНТМАДИ

Менеджер по продажам грузоподъемной техники II-ой категории

Россия

КДК-Прим

Исполнительный директор

Россия

КДК-Прим

Руководитель

Россия

КЕРАМЕТ

Генеральный директор к.э.н.

Украина

Кировчермет

Заместитель директора

Россия

Красный Октябрь

Начальник управления по обеспечению основными материалами и металлоломом

Россия

Крафтмаш

Генеральный директор

Россия

КТА.ЛЕС

Директор

Россия

ЛЕВЕЛ

Генеральный директор

Россия

Либхерр-Русланд

Менеджер по продажам

Россия

Либхерр-Русланд

Руководитель направления продаж

Россия

Либхерр-Русланд

Менеджер по продажам

Россия

Либхерр-Русланд

Менеджер по продажам

Россия

Маглюг

Вице-президент

Россия

Макс-ИнТрейд

Генеральный директор

Россия

Макс-ИнТрейд

Россия

МАТИ – Российский государственный технологический университет имени К.Э. Циолковского

Россия

МВС

Генеральный директор

Россия

МегаРекс

Руководитель представительства г.Москва

Россия

МегаРекс

Учредитель

Россия

МегаРекс

Директор

Россия

МегаРекс

Россия

МегаРекс

Россия

Мета г. Самара – центральный офис

Начальник отдела транзитных закупок

Россия

Мета г. Самара – центральный офис

Начальник отдела сбыта

Россия

Металика

Заместитель Генерального директора

Россия

Металика

Генеральный директор

Россия

Металком

Директор

Россия

Металл Эксперт Консалтинг

Руководитель проектов

Россия

МеталлИмпэкс, ТД

Генеральный директор

Россия

МеталлИмпэкс, ТД

Руководитель департамента экономики

Россия

Металлоснабжение и сбыт

Обозреватель

Россия

Металлпрофереработка

Руководитель проекта

Беларусь

Металлпрофереработка

Председатель совета директоров

Беларусь

Металл-Сервис г. Таганрог

Коммерческий директор

Россия

МеталлСтиль

Зам. генерального директора

Россия

Металлторг г. Владивосток

Генеральный директор

Россия

Металлторг г. Владивосток

Заместитель генерального директора

Россия

Метинвест Евразия

Маркетолог

Россия

Метинвест-Ресурс

Генеральный директор

Украина

Метинвест-Ресурс

Начальник отдела импорта

Украина

Метлайн СПб

Учредитель

Россия

Метлайн СПб

Генеральный директор

Россия

Метсо Минералз ГмбХ

Вице-президент

Россия

Метсо Минералз СНГ

Исполнительный директор

Россия

МЕТЭКС г. Калининград

Директор

Россия

МЗК

Директор

Россия

Министерство промышленности и торговли РФ

Ведущий консультант отдела промышленности черных металлов и железорудного сырья

Россия

Министерство промышленности и торговли РФ

Директор департамента металлургии и тяжелого машиностроения

Россия

Мицуи энд Ко. Москоу

Старший специалист отдела машин и оборудования

Россия

Мотовилихинские заводы

Директор по снабжению

Россия

Мотовилихинские заводы

Начальник отдела мониторинга рынков

Россия

Национальное объединение саморегулируемых организаций операторов по обращению с отходами производства и потребления (НОСОО)

Президент

Россия

Национальный банковский журнал

Россия

Нева-Трейд (СПб)

Генеральный директор

Россия

Нева-Трейд (СПб)

Коммерческий директор

Россия

Неверов Ильдар Алиевич

Бизнес-омбудсмен по экологии и природопользованию Управления Уполномоченного по защите прав предпринимателей при Президенте РФ; Представитель BIR в России

Россия

Новосталь

Генеральный директор

Россия

Нордком

Директор департамента металлолома

Россия

Норд-Металл

Генеральный директор

Россия

НТК

Начальник управления по работе с НЛМК-Сорт

Россия

Океан

Менеджер по закупкам легированных сталей

Россия

Океан

Главный специалист по легированным сталям

Россия

Океан

Генеральный директор

Россия

ОМК-ЭкоМеталл

Коммерческий директор

Россия

ОМК-ЭкоМеталл, Металлоломная компания

Генеральный директор

Россия

Орис Пром

Коммерческий директор

Россия

Оскольский электрометаллургический комбинат

Начальник отдела закупок металлолома и энергоносителей (ОЗМиЭ)

Россия

Останкино-2

Оператор

Россия

Переводчик

Россия

Петросталь

Начальник Управления закупки металлолома

Россия

Поволжская Алюминиевая Компания

Директор

Россия

Подъемные машины

Аналитик отдела маркетинга

Россия

Пром Мет

Генеральный менеджер

Россия

Промвест

Коммерческий директор

Россия

ПромИнвест

Учредитель, генеральный директор

Россия

ПромИнвест

Руководитель отдела закупок

Россия

ПромИнвест

Учредитель

Россия

ПромИнвест Алматы

Советник директора по коммерческим вопросам

Казахстан

Промтехнология

Генеральный директор

Россия

Промтехносеть

Юрист

Россия

Промтехносеть

Председатель Совета директоров

Россия

Промышленно-металлургический холдинг

Директор по связям с инвесторами (Группа КОКС)

Россия

Профит г. Магнитогорск

Заместитель директора по поставкам металлолома

Россия

Псковвтормет

Генеральный директор

Россия

РЖД-Партнер

Корреспондент журнала “РЖД-Партнер”

Россия

РосМет г. Санкт-Петербург

Директор

Россия

РосМет г. Санкт-Петербург

Генеральный директор

Россия

Ростовский электрометаллургический заводъ

Генеральный директор

Россия

РУСЛОМ.КОМ

Президент

Россия

Центр «Интеллектуальные ресурсы» МИСиС

Генеральный директор

Россия

Русмет

Старший аналитик

Россия

Русмет

Главный аналитик

Россия

Русская планета

Корреспондент

Россия

Рынок металлопроката и металлообработки

Главный редактор

Россия

Рынок металлопроката и металлообработки

Менеджер

Россия

Рынок металлопроката и металлообработки

Начальник отдела рекламы

Россия

Рязцветмет

Генеральный директор

Россия

Саморегулирование и бизнес (ООО “СРО Проф”)

Журналист

Россия

Санкт-Петербургская Промышленная Группа

Директор департамента развития

Россия

СГМК-Трейд

Специалист отдела маркетинга

Россия

СГМК-Трейд

Начальник коммерческого отдела

Россия

Северо-Западная Транспортно-Логистическая Компания

Первый заместитель генерального директора

Россия

Северсталь Вторчермет г. Череповец

Коммерческий директор

Россия

Сильные машины

Специалист по продажам

Россия

Сильные машины

Директор

Россия

Сильные машины

Представительство в Москве

Россия

СТМ-Холдинг

Генеральный директор

Россия

Таурус Трейд

Директор

Россия

ТМК

Главный специалист Управления маркетинга ВЭД

Россия

Толметс

Директор развития бизнеса

Латвия

Толметс

Руководитель отдела продаж

Латвия

ТрансЛом

Начальник департамента реализации металлолома

Россия

ТрансЛом

Начальник департамента маркетинга

Россия

ТрансЛом

Заместитель генерального директора

Россия

ТрансМетРесурсТрейд

Коммерческий директор

Россия

ТрейдАктивРесурс

Генеральный директор

Россия

ТрейдАктивРесурс

Коммерческий директор

Россия

ТрейдАктивРесурс

Директор

Россия

ТрейдАктивРесурс

Руководитель сервисной службы

Россия

ТрейдАктивРесурс

Коммерческий директор

Россия

УБТ-Экология

Менеджер

Россия

УБТ-Экология

Директор

Россия

УБТ-Экология

Главный инженер

Россия

УБТ-Экология

Начальник производства

Россия

УГМК-Сталь

Заместитель генерального директора по снабжению

Россия

УкрМет

Коммерческий директор

Украина

Укрмет, Украинская ассоциация предприятий черной металлургии

Член коллегии направления стального металлолома BIR

Украина

Уни-Блок

Россия

Уралвтормет Москва

Россия

Урал-Золото

Заместитель директора по сырью, член рабочей группы «Арктика» (Чилингарова А.Н.), руководитель направления утилизации ломов цветных и драгоценных металлов

Россия

Федерал Могул Набережные Челны

Заместитель генерального директора

Россия

Федерал Могул Пауэртрейн Восток

Аналитик по закупкам

Россия

Ферратек-Юг

Генеральный директор

Россия

Ферратек-Юг

Менеджер по продажам

Россия

Ферроком-сервис

Помощник руководителя

Россия

Фонд развития трубной промышленности

Директор

Россия

Хаммер Рус

Менеджер по продажам

Россия

Хаммер Рус

Генеральный директор

Россия

Хетек

Коммерческий директор

Россия

Хетек

Директор

Россия

ЦентрВторМет г. Брянск

Директор

Россия

Цеппелин Русланд

Менеджер

Россия

Чермет-Волжский

Директор

Россия

ЧерметИнвест-Т г. Москва

Генеральный директор

Россия

Чермет-СМК

Собственник

Россия

ЧС-Снабжение г. Екатеринбург

Генеральный директор

Россия

ЧС-Снабжение г. Екатеринбург

Коммерческий директор

Россия

ЧС-Снабжение г. Екатеринбург

Руководитель ОП(обособленное подразделение) г.Волжский

Россия

ЧТПЗ, филиал г. Москва

Специалист управления по стратегическому маркетингу

Россия

Экология в металлургии

Заместитель директора

Россия

Эконацпроект

Технический специалист

Россия

Экопрогресс

Руководитель коммерческого отдела

Россия

Экорециклинг

Генеральный директор

Россия

Экотеплосервис

Начальник отдела заготовки

Россия

Эксперт-Урал

Корреспондент

Россия

Venue

Hotel Renaissance Moscow Monarch Center *****